The Platform Thesis: Why African Energy Infrastructure Needs a New Valuation Paradigm

The Art of Pricing Tomorrow's Monopolies Today

The infrastructure investment world has a platform fetish. Brookfield drops €6.1 billion on Neoen for 8GW operating and 20GW of pipeline¹. TPG backs Intersect Power². BlackRock commits $500 million to Recurrent Energy's 26GW pipeline³.

But here's what most are not saying out loud: African platforms operate under completely different physics than their developed market counterparts. The valuation models designed for predictable OECD markets break down catastrophically when applied to African realities.

The Fundamental Disconnect: Why Platforms ≠ Aggregated Projects

Traditional platform theory says value comes from:

Economies of scale

Portfolio diversification

Operational synergies

Development expertise

This works in Silicon Valley. In Africa, platform value comes from solving three intractable problems:

1. The Institutional Void Navigation Premium: Platforms don't just develop projects—they become quasi-governmental institutions filling voids in market infrastructure.

2. The Time Arbitrage Engine: While developers race against cliff dates, platforms weaponize time as a competitive advantage.

3. The Complexity Absorption Capability: Platforms transform unknowable risks into manageable probabilities through sheer portfolio mass.

Let me explain why these create 10x more value than traditional synergies.

The Institutional Void Theory of Platform Value

Harvard professors Khanna and Palepu coined "institutional voids"—gaps in market infrastructure that increase transaction costs. African energy markets aren't just experiencing voids; they're mostly void with occasional islands of institution.

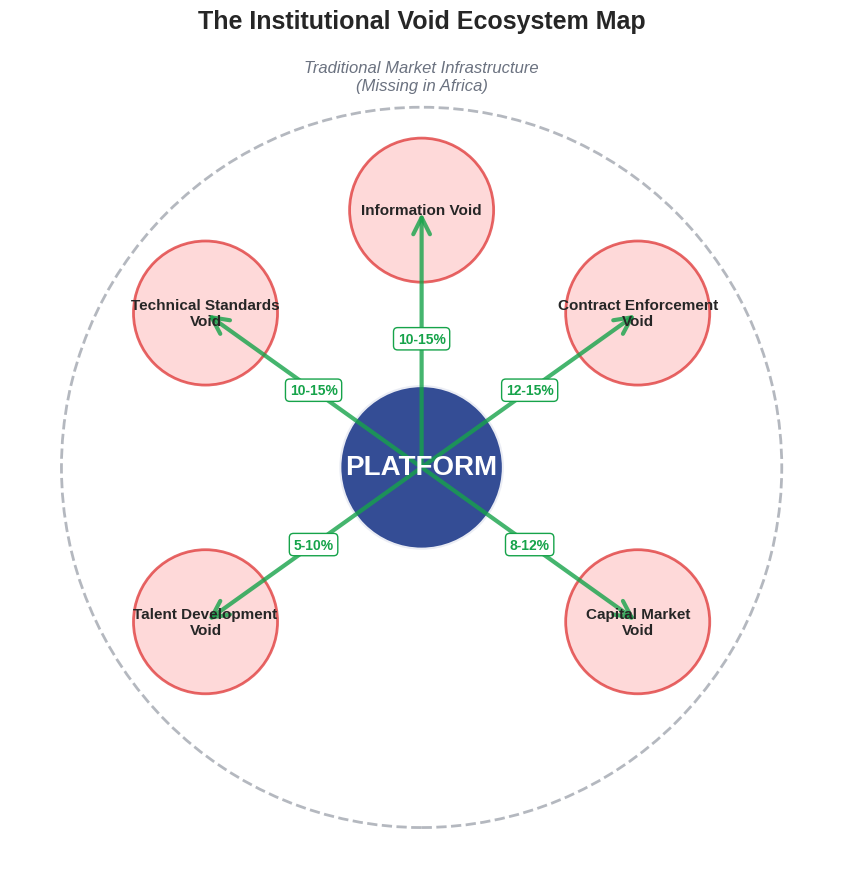

Platforms fill five critical voids:

1. The Information Void

The Problem: No centralized data on energy demand, grid capacity, or creditworthiness.

Platform Solution: A large platform operating across 22 countries becomes a living database of:

Actual industrial energy consumption patterns

Real payment behaviors by sector

True grid stability by region

Valuation Impact: Information asymmetry worth 20-30% premium. Platforms with 5+ years operating history have data competitors would need a decade to replicate.

2. The Contract Enforcement Void

The Problem: Legal systems that take 5-7 years to resolve commercial disputes.

Platform Solution: Reputation capital that makes contract breach economically irrational.

When you owe one project money, you have leverage. When you owe a platform with 50 projects money, they have leverage. MIGA's $495 million guarantee to CBE isn't just risk mitigation—it's creating a parallel enforcement mechanism.

Valuation Impact: 15-25% reduction in cost of capital versus standalone projects.

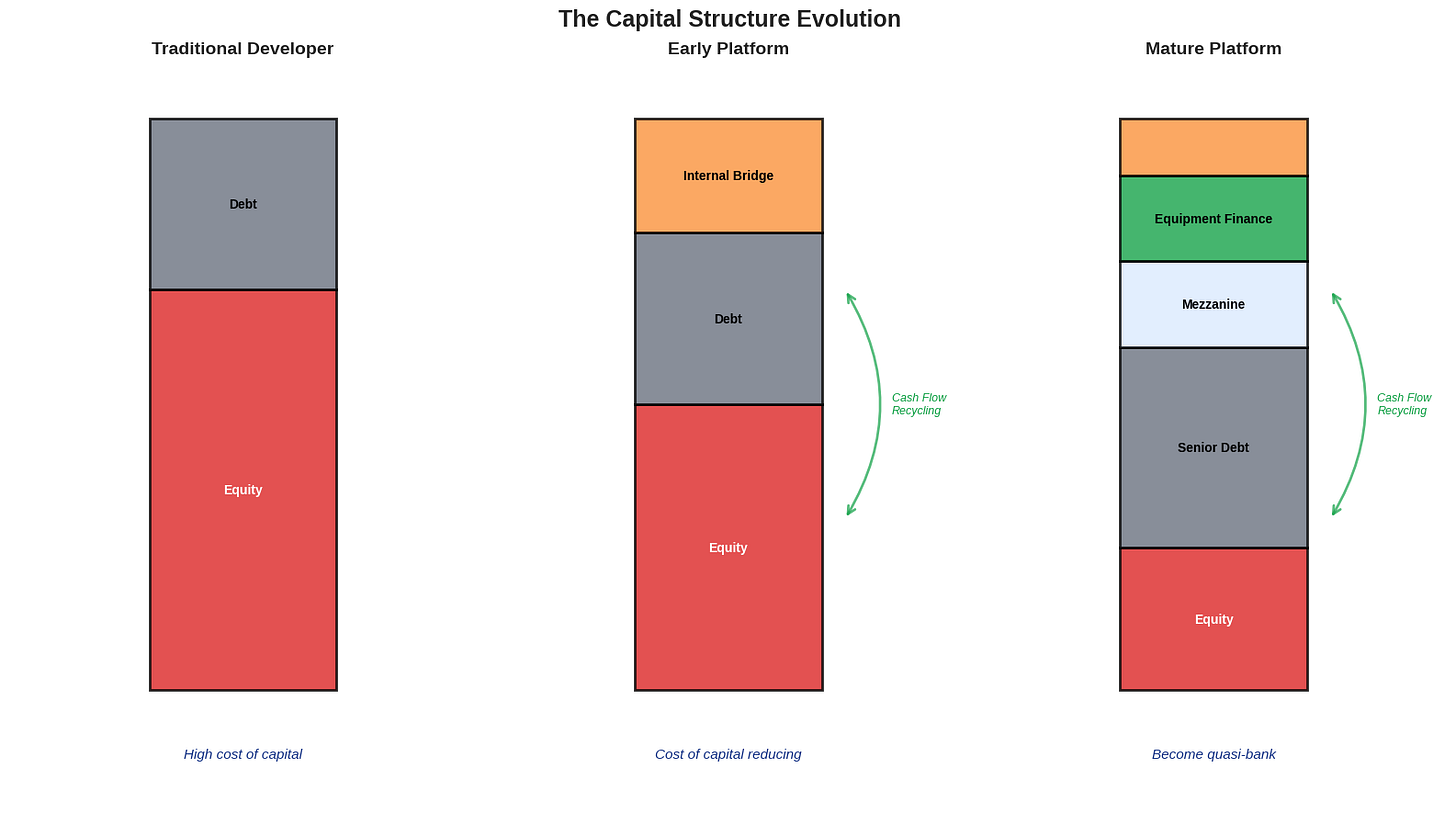

3. The Capital Market Void

The Problem: Local banks think 5 years is long-term. International banks think $50 million is too small.

Platform Solution: Become the bank.

Platforms increasingly provide:

Bridge financing to developers

Working capital to EPCs

Payment terms to equipment suppliers

Valuation Impact: Financial services arms worth 0.5-1x the infrastructure business.

4. The Talent Development Void

The Problem: Universities don't teach project finance. International talent doesn't understand local dynamics.

Platform Solution: In-house academies.

Leading platforms spend 5-10% of OpEx on training. They're not buying talent—they're manufacturing it.

Valuation Impact: Each fully-trained project manager worth $2-5 million in enterprise value.

5. The Technical Standards Void

The Problem: No local standards for renewable energy. International standards ignore local conditions.

Platform Solution: Become the de facto regulator.

Platform technical standards become market standards. Their procurement specs become industry requirements. Their HSE protocols become regulatory benchmarks.

Valuation Impact: Standard-setting platforms command 30-50% acquisition premiums.

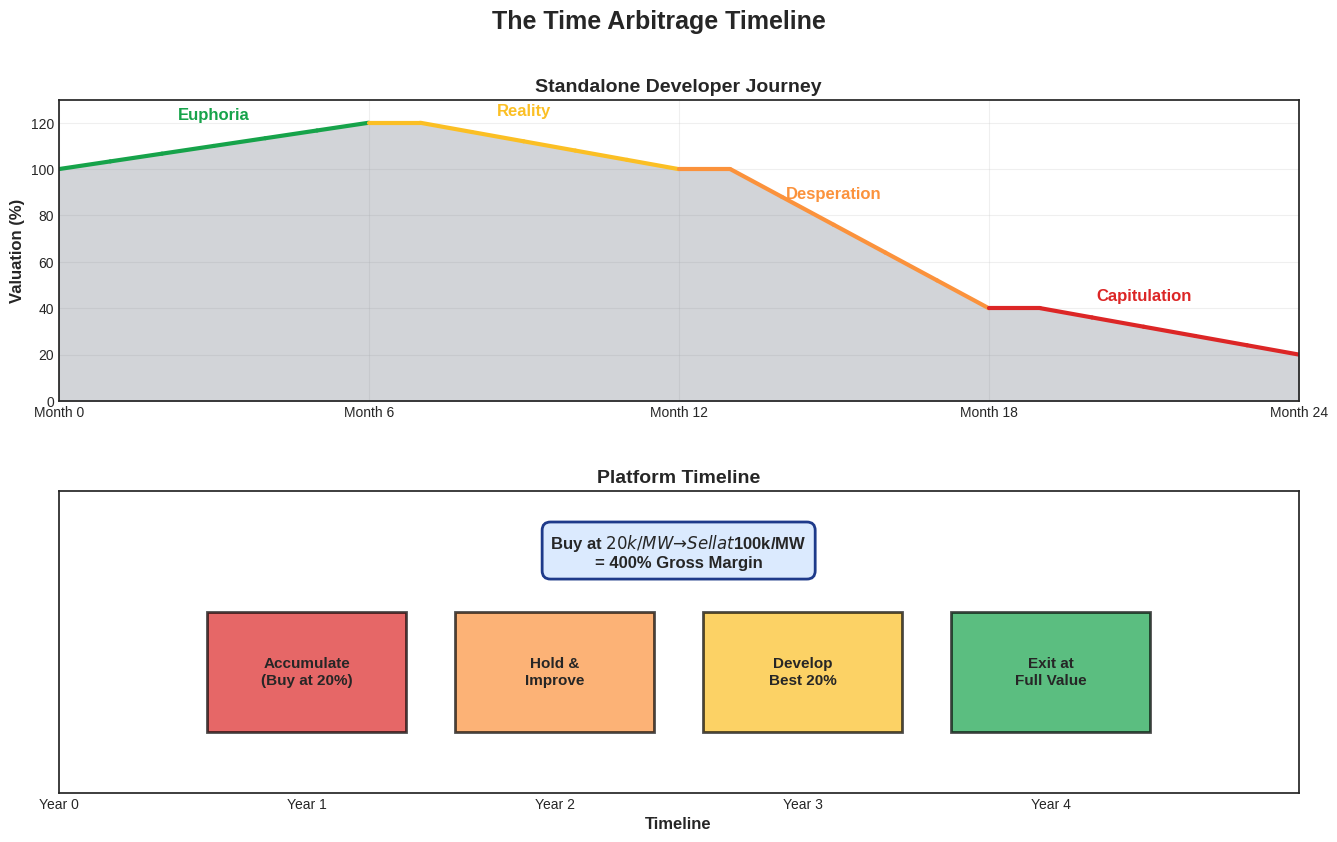

The Time Arbitrage Model

In Africa, pipelines are time machines.

Here's the arbitrage:

The Patience Premium

Standalone Developer Timeline:

Month 1-6: Euphoria ("This project will transform everything!")

Month 7-12: Reality ("Why does permitting take so long?")

Month 13-18: Desperation ("We need capital NOW")

Month 19-24: Capitulation (Sell for 20% of initial valuation)

Platform Timeline:

Year 1: Accumulate distressed projects at 20 cents on the dollar

Year 2: Hold and improve

Year 3: Develop best 20%

Year 4: Sell or build at full value

The Math: Buy distressed at $20k/MW, develop to RTB at $100k/MW. 400% gross margin.

The Portfolio Time Shifting

Platforms practice temporal arbitrage across their portfolio:

Revenue Time Shifting:

Use operating asset cash flows to fund development

Eliminates J-curve, creates immediate yield

Worth 10-15% valuation premium

Risk Time Shifting:

Start 5x more projects than needed

Kill poor performers early

Survivors have 80%+ success rate

De-risks entire portfolio

Capital Time Shifting:

Raise capital in good windows

Deploy during distress

2-3x better returns than market-timed investing

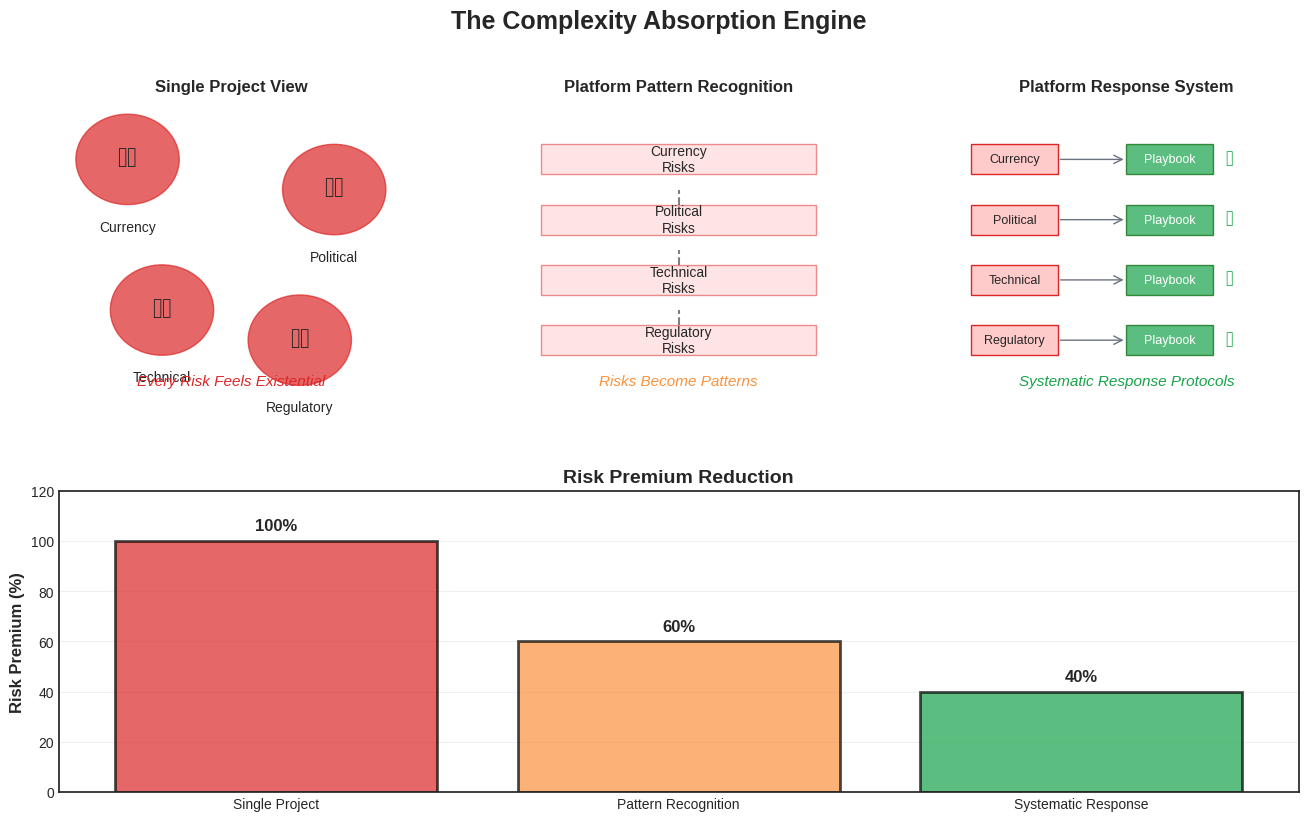

The Complexity Absorption Engine

African energy markets aren't complicated—they're complex. Complicated systems have many parts but predictable interactions. Complex systems have emergent behaviors that can't be predicted from individual components.

Platforms convert complexity into complication through three mechanisms:

1. The Pattern Recognition Algorithm

Single Project: Every risk feels existential

Platform with 100 projects: Risks become patterns

Example: Currency devaluation

Project response: Panic, renegotiate PPA

Platform response: "This is our 6th devaluation. Here's the playbook."

Valuation Impact: 40-60% lower risk premium in DCF models.

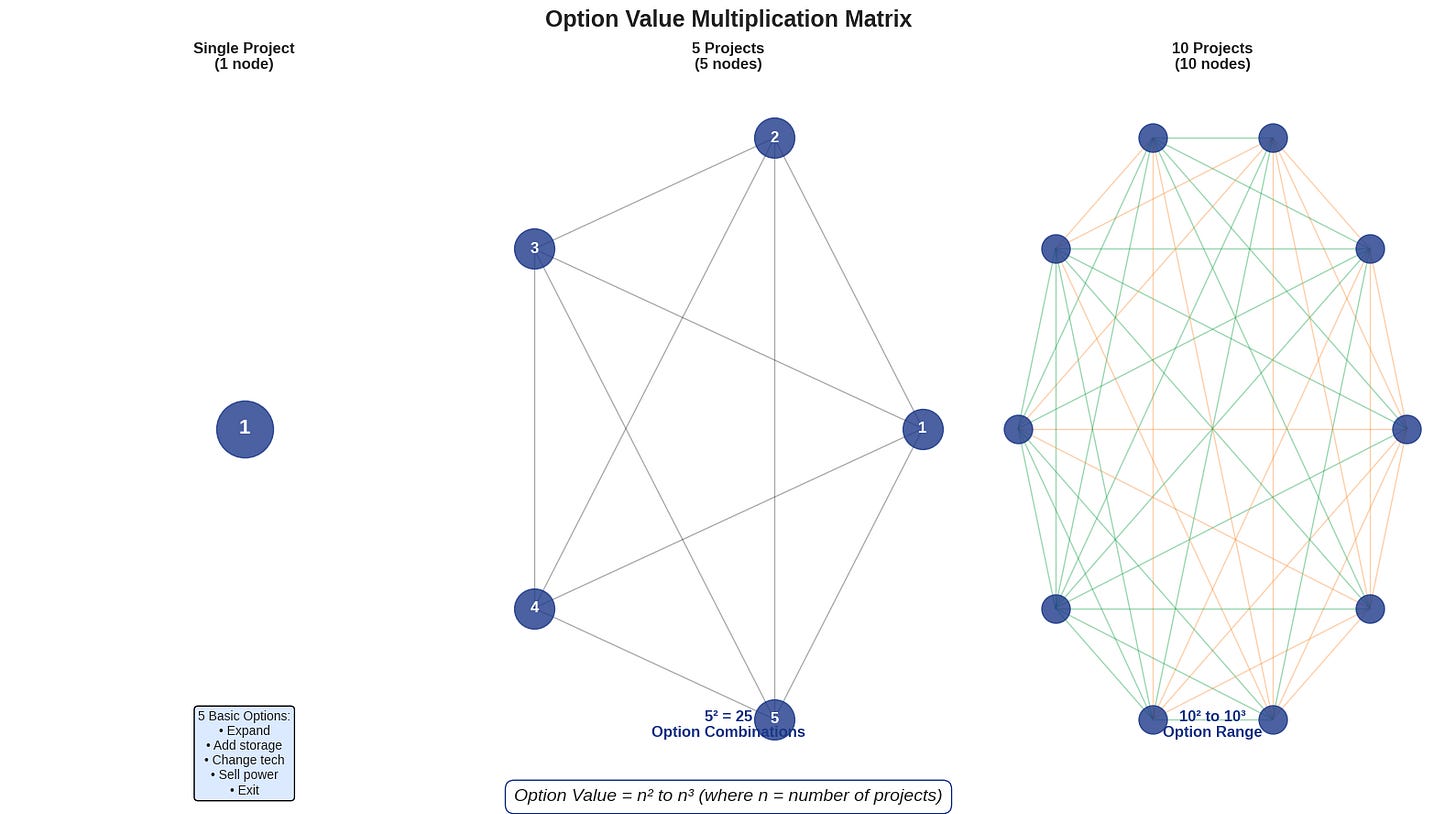

2. The Optionality Maximizer

Each project creates options:

Expand capacity

Add storage

Sell to grid vs. private off-taker

Develop adjacent land

Option Value Formula:

The interaction term is non-linear. 10 projects don't create 10x the options—they create 10² or 10³ options.

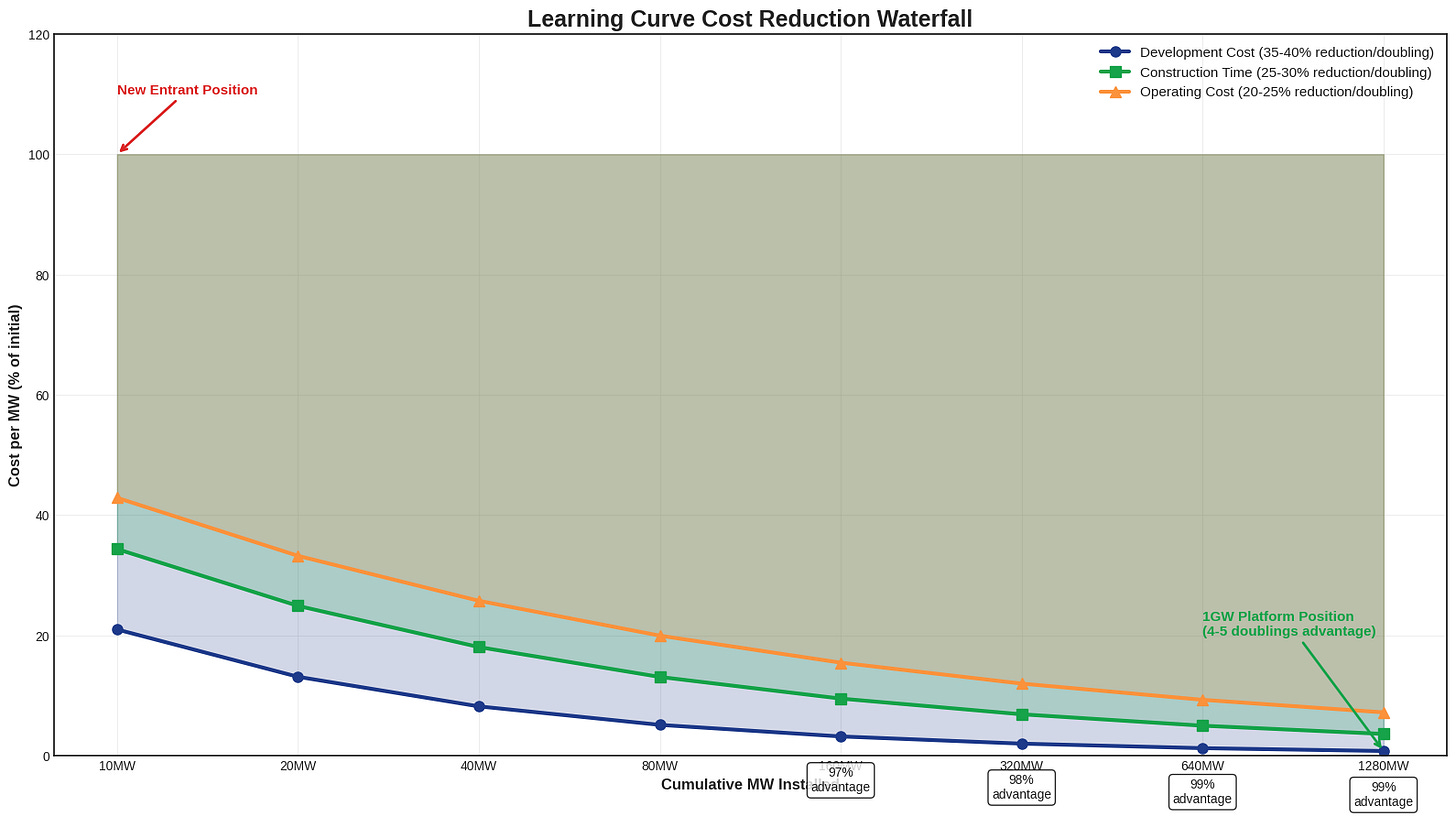

3. The Learning Curve Accelerator

Boston Consulting Group documented 20-30% cost reduction for each doubling of cumulative production in manufacturing. In African renewable platforms:

Cost Reduction per Doubling:

Development cost: 35-40%

Construction time: 25-30%

Operating cost: 20-25%

A platform at 1GW installed has 4-5 doublings advantage over new entrants.

The New Valuation Framework: Platform Value Stack

Forget DCF. Here's how to value African platforms:

Layer 1: Infrastructure Foundation Value

Traditional operating asset valuation. The boring part.

Layer 2: Institutional Premium

For each void filled:

Information systems: +5-10%

Contract enforcement: +5-10%

Capital provision: +10-15%

Talent development: +5-10%

Technical standards: +10-15%

Total possible: +45-70% over asset value

Layer 3: Time Arbitrage Value

Calculate NPV of:

Distressed acquisition opportunities

Patient capital deployment

Portfolio optimization

Typically: +20-40% over asset value

Layer 4: Complexity Management Value

Value of:

Lower risk premiums

Option creation

Learning curve position

Range: +30-60% over asset value

Layer 5: Strategic Control Value

Platform as:

Market maker

Standard setter

Consolidator

Gatekeeper

Premium: +50-100% for market leaders

Total Platform Multiple: 2.5-4x infrastructure asset value

What Kills Platform Value

1. The Complexity Trap

Platforms operating in 20+ countries often discover complexity costs scale exponentially while benefits scale linearly. Optimal size: 8-12 countries with cultural/regulatory similarities.

2. The Talent Leakage

Train someone for 3 years, they leave in year 4. Without golden handcuffs, platforms become talent exporters. Solution: Equity participation down to project manager level.

3. The Success Paradox

Successful platforms attract government attention. Suddenly you're "too profitable" or "too foreign." Political risk INCREASES with success.

4. The Integration Illusion

Acquiring 10 developers doesn't create 1 platform. Integration costs typically 2x acquisition price and fails 60% of the time.

The Platform Endgame: Three Futures

Scenario 1: The Utility Evolution (40% probability)

Platforms become de facto utilities. Governments nationalize or regulate. Returns compress to utility levels (8-12%). Timeline: 5-10 years.

Scenario 2: The Super-Platform Emergence (35% probability)

3-5 continental champions emerge. $10-20 billion valuations. African energy becomes investible at scale. Timeline: 3-7 years.

Scenario 3: The Fragmentation Continuation (25% probability)

Market remains fragmented. Platforms stay subscale. Returns stay high but capital access remains limited. Timeline: Indefinite.

The Investment Implications

For Investors:

Stop modeling African platforms like OECD infrastructure

Value institutional void filling, not just synergies

Price in political success risk, not just failure risk

Demand equity retention for key talent

For Platforms:

Focus on depth (institutional void filling) over breadth (geographic expansion)

Build talent retention into DNA

Prepare for utility-style regulation

Create options, not just projects

For Governments:

Platforms are solving your infrastructure problems

Partner, don't prey

Regulate outputs, not returns

Learn from platform standards

The Conclusion: Platforms as Nation Builders

The Brookfield-Neoen deal valued pipeline at €200-300/kW for early stage projects. In Africa, leading platforms will achieve similar valuations not through pipeline dreams but through institutional reality.

They're not just building power plants. They're building the market infrastructure that makes power plants possible. They're creating the standards, training the talent, providing the capital, and absorbing the complexity that transforms impossible projects into inevitable infrastructure.

Value them not as aggregators of projects but as architects of markets. The premium isn't for what they own—it's for what they enable.

Current platform valuations assume they're competing with other developers. The reality? They're competing with multilateral development banks, government agencies, and technical universities for the role of market builder.

The winners will be valued like institutions, not investments. Plan accordingly.

—S

References

Infrastructure Investor. (2024, October 1). "Pipelines or pipe dreams? Valuing renewables platforms." Infrastructure Investor. https://www.infrastructureinvestor.com/pipelines-or-pipe-dreams-valuing-renewables-platforms/

TPG. (2023, September 15). "TPG Rise Climate Backs Intersect Power in $750 Million Growth Investment." TPG Press Release. https://www.intersectpower.com/intersect-power-announces-750m-growth-equity-investment-from-tpg-rise-climate-cai-investments-trilantic-energy-partners-north-america/

BlackRock. (2024, March 22). "BlackRock Real Assets Commits $500 Million to Recurrent Energy's Solar Pipeline." BlackRock Newsroom. https://recurrentenergy.com/blackrock-commits-500m-to-energy-storage-and-solar-project-developer-recurrent-energy/

Phoenix Strategy Group. (2025, January). "Key Valuation Multiples in Renewable Energy Deals: Q4 2024 Update." Phoenix Strategy Group Research. https://www.phoenixstrategy.group/blog/key-valuation-multiples-in-renewable-energy-deals

Apricum Group. (2020, October 19). "Taking part in the growing corporate M&A sector for renewables: Key valuation approaches explained." Apricum - The Cleantech Advisory. https://apricum-group.com/taking-part-in-the-growing-corporate-ma-sector-for-renewables/

Hodge, L. (2019, March-April). "How to Value a Solar Development Pipeline, Parts 1-4." Greentech Media. https://www.greentechmedia.com/articles/read/how-to-value-a-solar-development-pipeline-part-4

Khanna, T., & Palepu, K. (1997). "Why focused strategies may be wrong for emerging markets." Harvard Business Review, 75(4), 41-51. https://hbr.org/1997/07/why-focused-strategies-may-be-wrong-for-emerging-markets

Lawrence Berkeley National Laboratory. (2024, April). "Queued Up: Characteristics of Power Plants Seeking Transmission Interconnection As of the End of 2023." Berkeley Lab. https://emp.lbl.gov/publications/queued-characteristics-power-plants

Khanna, T., & Palepu, K. (2010). Winning in Emerging Markets: A Road Map for Strategy and Execution. Harvard Business Press. ISBN: 978-1-4221-6663-5

CrossBoundary Energy. (2025, June). "CrossBoundary Energy Portfolio Overview: 22 Countries, 276 MW, 211 MWh Storage." Company Presentation. https://crossboundaryenergy.com/

Multilateral Investment Guarantee Agency. (2025, July 14). "MIGA to Support Over 100 Energy Projects in up to 20 African Countries." MIGA Press Release. https://www.miga.org/press-release/miga-support-over-100-energy-projects-20-african-countries

Hull, J. C. (2022). Options, Futures, and Other Derivatives (11th ed.). Pearson. Chapter 22: "Real Options." ISBN: 978-0-13-693997-2

Bain & Company. https://www.bain.com/insights/topics/m-and-a-report/

McKinsey & Company. (2024). "M&A Trends in 2024." McKinsey on M&A. https://www.mckinsey.com/capabilities/m-and-a/our-insights/top-m-and-a-trends-in-2024-blueprint-for-success-in-the-next-wave-of-deals

Lazard. (2024, October). "Lazard's Levelized Cost of Energy Analysis—Version 17.0." Lazard Insights. https://www.lazard.com/media/xemfey0k/lazards-lcoeplus-june-2024-_vf.pdf

CrossBoundary Energy. (2025, March 5). "CrossBoundary Energy Receives $45m Investment from EAAIF." https://www.africaglobalfunds.com/news/private-equity/deals/eaaif-invests-45m-in-crossboundary-energy/

Impact Investor. (2025, June 26). "Octopus Energy Generation launches $250m African clean energy fund." https://www.impact-investor.com/octopus-energy-generation-launches-250m-african-clean-energy-fund/

Global Solar Council. (2025). "Africa Market Outlook for Solar PV 2025-2028." GSC Publications. https://www.globalsolarcouncil.org/resources/africa-market-outlook-for-solar-pv-2025-2028/

Ecofin Agency. (2025, February 13). "African Tech Startup M&A Activity Grows 34% in 2024 (Report)." https://www.ecofinagency.com/finance/1702-46427-african-tech-startup-m-a-activity-grows-34-in-2024-report

Sustainable Tech Partner. (2024, February 2). "M&A: 70 Sustainable Technology & Renewable Energy Buyers, Sellers, Investors for January 2024." https://sustainabletechpartner.com/topics/ma/70-sustainable-technology-renewable-energy-buyers-sellers-investors-for-january-2024/

Disclaimer:

Look, we need to have a talk. The uncomfortable kind where I tell you that despite spending the last 3,000 words sounding like I know what I'm talking about, I definitely don't know what I'm talking about. At least not in any way that should influence you to wire money to anyone based on my ramblings.

Nothing here constitutes investment advice, financial advice, or any kind of advice that involves actual money changing hands.

Remember that bit about checking my math? I wasn't being cute. The point is: verify everything. Trust nothing. Especially the formulas.

Some numbers in this post are composites, averages, or educated guesses based on deals I've seen. I've anonymized everything more thoroughly than a witness protection program. If you think you recognize your deal, you don't. If you're sure you do, you still don't.

References to specific companies, platforms, or transactions do not constitute endorsement or recommendation. All company names and trademarks are the property of their respective owners.

Before you do anything based on this blog, talk to actual professionals. The kind with licenses, insurance, and offices that aren't coffee shops. They charge money because they actually know things, unlike your humble blogger who just pattern-matches.

Every model in this post is simplified. Real valuations require real work, not blog-post approximations. My frameworks are starting points, not ending points.

The "Copyright But Not Really" Notice: © 2025 The Impostor's Guide to Clean Energy. Feel free to share, quote, or mock this content. Just don't blame me when your investment committee asks hard questions about where you got these ideas.

I write under a pseudonym because I'm either protecting my identity or admitting I'm not qualified to use my real name. You decide which. Either way, form your own opinions.

This blog exists because I learn by writing, not because I know by knowing. If my confusion helps your clarity, we both win. If my confusion increases your confusion, at least we're confused together.

For corrections, complaints, or commiseration: kaykluz@yahoo.com

Remember: In renewable energy, as in life, the only guarantee is that there are no guarantees. Except circular references. Those are guaranteed.

Last updated: When I remembered to update it

Next update: When I remember to update it again